Margin loan on 401k

Rates on 10-year fixed-rate refinance loans averaged 544. Seeking the upside of.

3 Ways To Borrow Against Your Assets Retirement Plan Services

This means that movements in interest rates can more deeply impact a 30-year loan than a loan with a 10 or 15-year term.

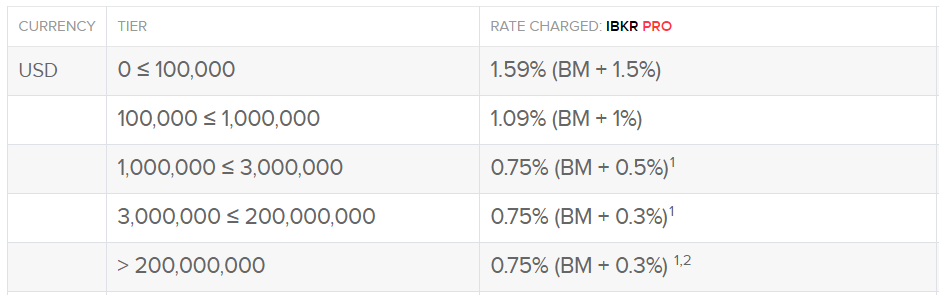

. Mortgage Loans generally carry a lower rate of interest when compared with personal loans. Margin interest rates vary among brokerages. The loan generally carries a higher rate of interest.

Mortgage loans are always secured as they are backed by collateral. Thinkorswim 10 years in a row Active Trading 2 years in a row Options Trading Customer Service and Phone Support. Auto Lease Calculator.

Borrowers should also understand the distinction between APR and. For borrowers with credit scores of 720 or higher who used the Credible marketplace to select a lender during the week of Aug. Brokerage fees associated with but not limited to margin transactions special stock registrationgifting account transfer and processing and termination apply.

In most cases loans are an option only for active employees. Its revenue was just over 200 million a year-over-year increase of 144. How to pay off a 401k loan early.

And are commonly the investment vehicle found in menus for employer-sponsored retirement plans such as a 401k. Margin and Markup Calculator. Hourly to Salary Calculator.

Roth 401K vs 401K Traditional IRA. 401k Save the Max Calculator. Additionally borrowers should consider the duration of the loan.

A loan is a contract whereby a lender loans money to a borrower in return for interest payments and the return of the borrowed funds after the loan agreement. Including 401k and 403b. Make Bi-Weekly Payments on a Loan.

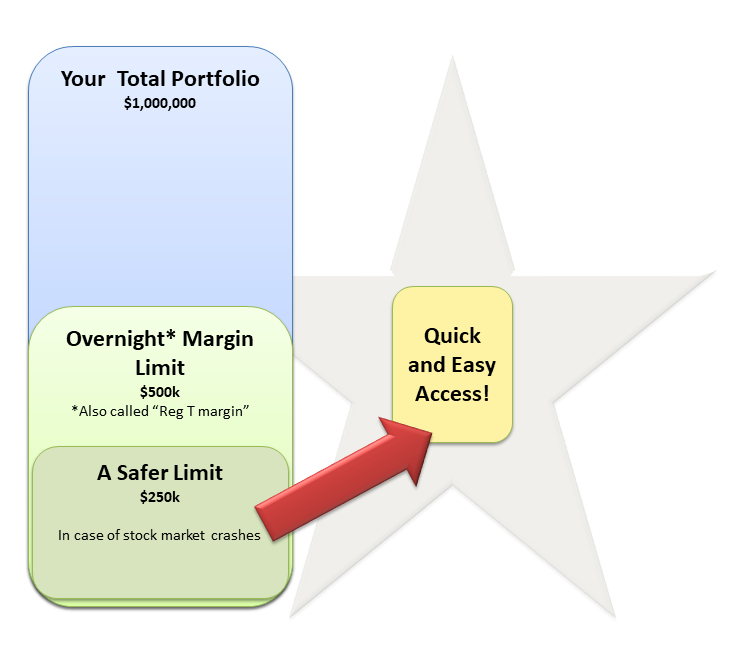

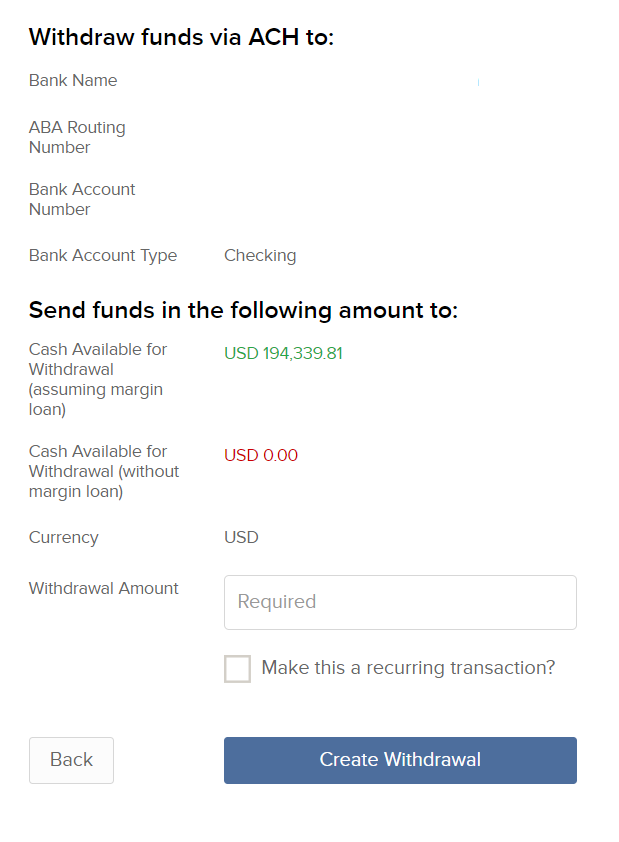

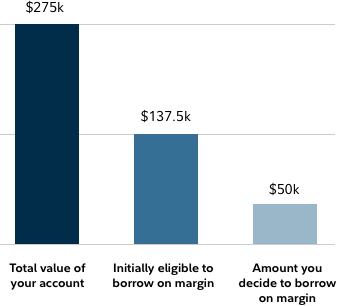

Margin and Markup Calculator. Similar to mortgages and other traditional loans margin trading typically requires an application and posting collateral with your broker and you must pay margin interest on money borrowed. 1 The amount you can borrow on margin is typically limited to 50 of the value of.

How Much to Save for Retirement. Loan Calculator Required field. There are a lot of headlines out there but we distill it down.

These episodes are a sampling of the weeks financial news and the impact on your personal finances. M1 Borrow Review How M1s Margin Loan Works. Most 401k loans have a 5-year term.

However most of the numbers on its Q1 2022 earnings look quite strong. Five-year annualized returns should be. Credit Card Debt Calculator.

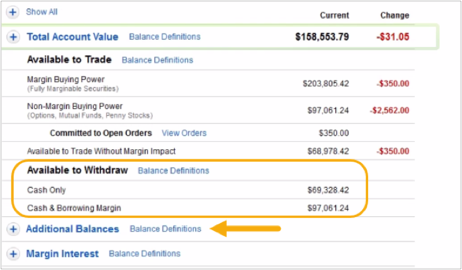

US Paycheck Tax Calculator. In many cases securities in your account can act as collateral for the margin loan. You can repay your 401k loan early through a lump-sum payment or by increasing your payroll deductions.

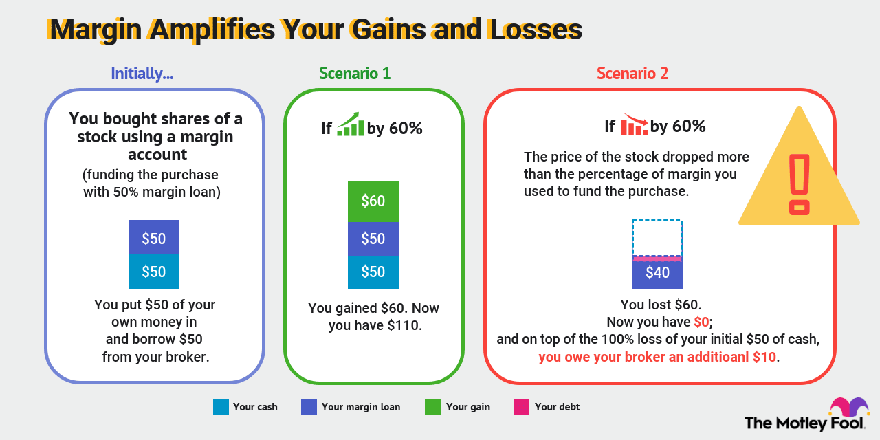

Just as a bank can lend you money against the equity in your home your brokerage firm can lend you money against the value of eligible stocks bonds exchange-traded funds and mutual funds in your portfolioMargin loans typically require a minimum of 2000 in cash or marginable securities and generally are limited to 50 of the investments value. The companys profit margin was 128 a YoY increase of 159. A high-level overview of VICI Properties Inc.

Roth 401K vs 401K Traditional IRA. Consider a loan from a margin account. How does a 401k loan work.

The definition of a margin call is when an investor buys stock on margin and that stock decreases in value to a certain degree then the broker will issue a margin call to the investor to prompt them to either pony up. 401k Save the Max Calculator. You may be eligible to apply for a modification on your commercial or SBA loan and you could qualify for.

Its net income was up significantly with a YoY increase of close to 200 closing the quarter at 256 million. Social Security Benefits Estimator. Loan Amount Interest Rate per.

Personal Loan Rates. Use a Lump Sum to Pay Down Debt. Meet a Debt Payoff Goal.

Time for our Friday Flight. The easy to use online Margin Call Calculator makes it easy to learn how to calculate margin calls for your portfolio with just a few key presses. With a 401k loan all youre doing is taking out a personal loan.

To begin margin borrowing against securities in a Schwab brokerage account you need at least 2000 in cash or marginable securities. They trade at the true intrinsic value of the fund known as the NAV or Net Asset Value allowing investors to avoid price fluctuation due to market forces during intraday trading. Generally the longer the loan term the greater the impact of rate fluctuations.

Accounts Receivable Turnover Formula. Learn about margin trading and discover why trading on margin can help build your investment strategy and financial portfolio from the experts at TD Ameritrade. 1 To begin margin borrowing against securities in a Schwab brokerage account you need at least 2000 in cash or marginable securities.

401k Rollover to IRA. Stay up to date on the latest stock price chart news analysis fundamentals trading and investment tools. If you opt for a 401k loan or withdrawal take steps to keep your retirement savings on.

Taxing Loan Forgiveness Everyday Money Fights Virtuous Investing Episode 567. Any stock that satisfies the other criteria has also outperformed the SP 500 by a comfortable margin. For the financial system to function loans are a vital component.

Each plan is different so discuss your options with human resources or your 401k plan administrator. Other fees and restrictions may apply. A 401k loan may be a better option than a traditional hardship withdrawal if its available.

Pricing is subject to change without advance notice. Loans can be secured or unsecured. Auto Loan and Lease Auto Loan Calculator.

Freedom From Debt Calculators. Loans period are less when compared with mortgage loans. The firm was rated 1 in the categories Platforms Tools 11 years in a row Desktop Trading Platform.

A margin loan. 0 option trades are subject to a 065 per-contract fee.

Why Paying 401 K Loan Interest To Yourself Is A Bad Investment

The Margin Loan How To Make A 400 000 Impulse Purchase Mr Money Mustache

The Margin Loan How To Make A 400 000 Impulse Purchase Mr Money Mustache

What Is Margin And Should You Invest On It

Margin Loans How It Works Fidelity

The Margin Loan How To Make A 400 000 Impulse Purchase Mr Money Mustache

401 K Guide What Is A 401 K Plan And How Does It Work

All About The Benefits Of Margin Trading

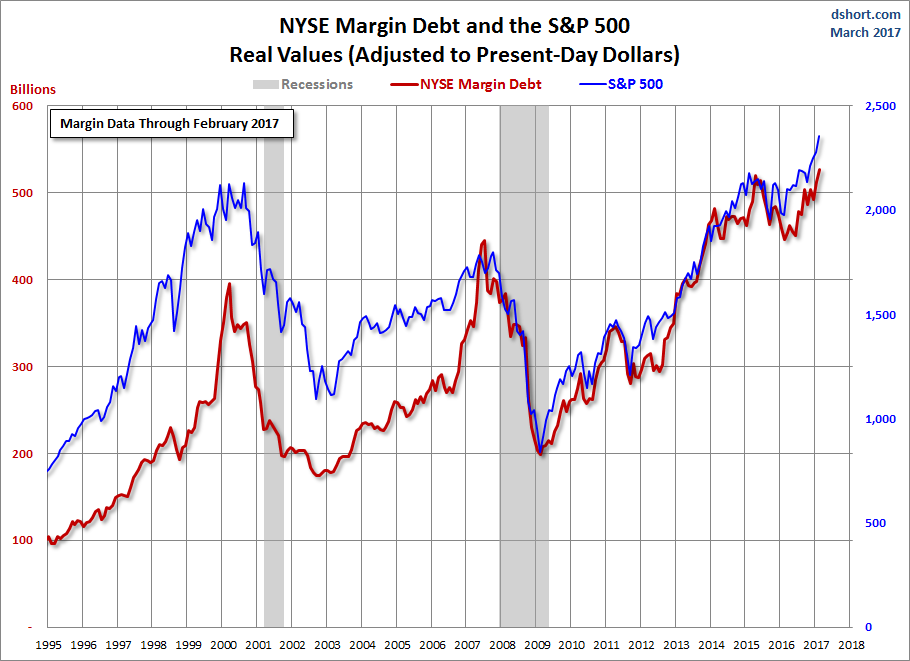

Does It Matter That Margin Debt Just Hit A New All Time High Seeking Alpha

Using Leverage In Retirement Swr Series Part 49 Early Retirement Now

Why Paying 401 K Loan Interest To Yourself Is A Bad Investment

Margin Loans How It Works Fidelity

401 K Withdrawals What Know Before Making One Ally

Solo 401k Faqs My Solo 401k Financial

Why Paying 401 K Loan Interest To Yourself Is A Bad Investment

Why Paying 401 K Loan Interest To Yourself Is A Bad Investment

M1 Borrow Review Super Low Interest Margin Loans